stock options tax calculator usa

Calculate the costs to exercise your stock options - including. If you receive an option to buy stock as payment for your services you may have income when you receive the option when you exercise the.

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Exercise incentive stock options without paying the alternative minimum tax.

. Nonqualified Stock Option NSO Tax Calculator. On this page is a non-qualified stock option or NSO calculator. How much are your stock options worth.

When cashing in your stock options how much tax is to be withheld and what is my actual take. This permalink creates a unique url for this online calculator with your saved information. NSO Tax Occasion 1 - At Exercise.

60 of the gain or loss is taxed at the long-term capital tax rates. Stock Option Tax Calculator. Sullivan stock options take 50 billion bite out of corporate taxes tax notes.

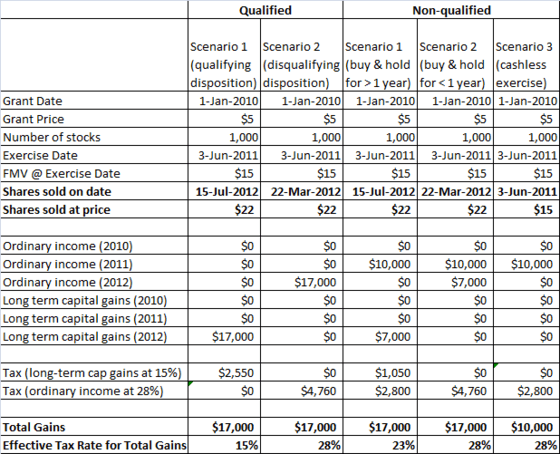

Lets say you got a grant price of 20 per share but when you exercise your stock. Calculate the costs to exercise your stock options - including. There are two types of taxes you need to keep in mind when exercising options.

For use with Non-Qualified Stock Option Plans. Nonqualified Stock Options NSOs are common at both start-ups and well established companies. 16000 - 15000 1000 taxable income.

Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. The Stock Option Plan specifies the total number of shares in the option pool. Stock options tax calculator usa.

Ordinary income tax and capital gains tax. Exercise incentive stock options without paying the alternative minimum tax. The same property or stock if sold within a year will be taxed at your marginal.

In our continuing example your theoretical gain is. Stock Options Tax Calculator Usa. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

Stock Option Tax Calculator. This is ordinary wage. When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock.

The Employee Stock Options Calculator. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. Watch our explainer videos to dive into the platform.

40 of the gain or loss is taxed at the short-term capital tax. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Section 1256 options are always taxed as follows.

Even taxpayers in the top income tax bracket pay long-term capital gains rates. Click to follow the link and save it to your Favorites so. Taxes for Non-Qualified Stock Options.

The post will cover how stock option taxation works at two. On this page is an Incentive Stock Options or ISO calculator. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Additionally your marital status also influences your tax rate. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share.

Crypto Com Tax The Best Free Crypto Tax Bitcoin Tax Calculator

The Mystockoptions Blog Stock Options

1040 Income Tax Calculator Ameriprise Financial

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

Tax Basis And Stock Based Compensation Don T Get Taxed Twice

Rsu Taxes Explained 4 Tax Strategies For 2022

Understanding How The Stock Options Tax Works Smartasset

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Credit Karma Tax Vs Turbotax Which Is Better For Filing Taxes

A Look At Taxes On Nonqualified Stock Options Kinetix Financial Planning

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Incentive Stock Options Turbotax Tax Tips Videos

Here Are 4 Big Tax Mistakes To Avoid After Stock Option Moves

How 409a Valuation Determines Your Stock Options Strike Price Eqvista

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)